Frequently Asked Questions

- If you are a business owner and need money to grow

- If you think or have experienced that getting a loan is difficult, we have designed our process to simplify your loan journey

- Multiple lender and our business understanding improves the chances of getting a loans multifolds

- Our loans are flexible and customized to your need going upto 1 Crores

Get a loan, repay on time and build your credit score and become eligible for better loans from us.

- Interest rates starting from Rs. 50 per day per lac or 1.5% per month, calculated on a reducing balance

- One time processing fee starting at 3%

- Our loans are unsecured and no collateral is needed as security

- Our loans are for business use only

- Use it for business expansion, renovation, purchase of equipments, hiring new staff, or spend on marketing

- Apply for business loan online at www.indifi.com

-

You need to provide a copy of your

- PAN card,

- Aadhaar Card

- Address proof of self and firm

- Business registration proof

- Bank Statement of last nine months.

- In case of loan more than 15 lacs, latest ITR

- Products include term loans, line of credit/OD, invoice financing and merchant cash advance

- Indifi business loans are customized for the various segments

- Indifi offers loan solutions for manufacturer, traders, service providers and retailers

- We have custom loans for travel agents, hotels, restaurants, retailers and ecommerce businesses

A term loan is the flexible, stable way of getting more working capital, developing your business, and making your credit. If you are seeking an easy small business loan, this is it. Term loans for businesses are helpful when the financing need is time-bound and properly described. These loans have a particular payback term and can provide floating or fixed interest rates. Depending on the tenure, terms loans can be classified into long-term, short-term and intermediate-term loans. Terms loans can be either secured or unsecured and serve different purposes like purchasing new equipment, increasing working capital, or expanding office premises.

The finances obtained in a business term loan are sometimes applied to instant expenses. Apart from banks and credit unions, FinTech firms now offer this loan. Every business term loan is different. The loan amount usually ranges anywhere from a few thousand to several lacs. Your business or personal credit score, time length in business operation, and revenue of your company are fundamental factors which decide how much a financial lending institution wants to provide and what the rate of interest for that loan will be. Generally, the APR (Annual Percentage Rating) starts around 6% and reaches up to 99%.

If you are seeking frequent cash inflow, the line of credit is the best option. With a line of credit, businesses are offered a credit limit they can take up against whenever they require it and are free to use the funds on the expenses of their choice. Line of credit is best for short-term operating purposes and for instant revenue-creating activities because the entrepreneur can use funds when he/she requires them. After opening a line of credit, you will get fund access. Then you will get a monthly invoice reflecting the credit amount you have used alongside interest charges (if any). Your payment depends on the actual interest accrued on these funds while you utilize them. Once you repay the funds, the amount is available for use. You will just be charged interest on the loan amount you use.

Features of Line of Credit:

- Interest charged on a daily basis

- Interest charged only on used amount

To qualify for a short term loan, meet the eligibility criteria given below:

- Your business needs to have a minimum operational history of 1 year with valid business proof.

- You must be an Indian resident.

- Your age needs to be over 21 years.

- You need to have a valid Indian bank account.

- Business & personnel KYC details

- 6 month banking of current account, if not current in case of proprietorship saving account banking in which payments for business are being received is required.

- Statement of CC/ OD Limits, if any are to be provided

Invoice discounting is a working capital solution which helps businesses in getting advances on cash that are due from the clients, instead of waiting for those clients to pay. Invoice discounting has become a prime source of working capital funds which relies on collaterals of the invoice due from the debtor if the amount is borrowed from a traditional lender. There is unsecured invoice discounting which is an alternative to conventional business loans that offers you immediate access to cash stuck in your outstanding invoices. With an invoice discounting, don’t wait to get paid by your customers, rather get instant money against your invoices through Indifi.

Several small business owners cannot acquire conventional bank loans because they don’t have sufficient collateral or credit. Hence, Merchant Cash Advance is best suited for such businesses with significant transactions occurring through card swipes. It advances cash to merchants depending on predicted future sales, providing an alternative to the traditional bank loan. With a Merchant Cash Advance, businesses get an amount of money in return for a percentage of their future earnings. Businesses basically require money to maximize credit, stock more inventory, reach out to more clients or extend their operation and a Merchant Cash Advance helps businesses meeting their instant cash needs.

The eligibility criteria for a Merchant Cash Advance loan against POS machine are as follows:

- Promoter’s age should be over 24 years.

- At least 2 years of business operational history.

- Minimum 6 months of card swipe history.

- 2 years income tax returns for loans over 10 lacs.

- Minimum monthly transaction of INR 50000.

- Businesses which accept debit and credit card payments.

- Business should offer at last nine month bank statement.

- GST Certificate

- Businesses should have a physical office location.

- Not all businesses are eligible for this loan. So maintaining the aforementioned criteria is must.

- GST returns for the last 1 year.

- 2 years of complete audit report for more than 10 lacs.

- Promoter’s age should be more than 24 years.

- Minimum business operational history should be 1 years.

Overdraft Facility or Credit Line is a financial instrument in which you can withdraw funds from your current or savings account, even in case your account balance is NIL. Nearly every financial lender offers this facility, incorporating NBFCs and banks. It’s a kind of short-term loan to be paid back in a defined duration as needed by the lender.

To borrow the overdraft facility, a small business must meet the following eligibility criteria:

The development of eCommerce in India has allured several international and domestic agencies to this industry. And it has considerably increased the competition for small online businesses. To beat this competition and allure more buyers, small sellers require investing in their online business consistently. And eCommerce business loan is the best way to maintain this consistency of funds.

In order to apply for an eCommerce business loan, you need to keep softcopies of the following documents ready to make sure a seamless, fast application procedure:

- KYC documents of your organization & business registration proof.

- GST certificate mandatory & latest GST filing.

- Bank account statements of the past 6 months.

It’s now easier to qualify for a hotel business loan from Indifi. All you need to do is to meet the following eligibility criteria in order to reap the benefits of the loan:

- Your age needs to be 22 and above.

- Your business needs to have an operational year of at least 1 years.

- Your business needs to have its income tax returns for at least the last 1 year.

You may have to submit other appropriate financial documents when it comes to verifying all documents provided by you. You will get information regarding this when needed.

The eligibility criteria to get a shop loan at Indifi are:the loan:

- The applicant should be an Indian citizen.

- The business location must also not be in remote areas.

- The applicant’s age must be between 24 years and 60 years.

- If your business is already developed and you will apply for a loan, your business should be in operation for at least 18 months.

- Business should have valid GST/Shop Act/Gumasta/Registration Proof.

- In care of rented property notarized/registered rent agreement at least 3 months old.

- Maximum business loans need a minimum turnover amount 50K to 1 Crores.

The basic documents required for a shop loan are:

- Last 6 months’ bank account statement.

- The identity proof of the applicant like PAN card, driver’s license.

- Business PAN card

- Business documents such as a sole proprietorship declaration.

To qualify for a restaurant business loan, you will need to show that your business is a good risk. This implies having sufficient experience and a good credit score. No requirement of collateral if you are taking up this loan from a digital lender like Indifi. You will need to convince your lender that you are ready to make a successful business. Lenders need to know precisely how you can plan for spending money they loan to you. Ensure to end up with the loan which you can afford to pay back, or investment partners with whom you want to work.

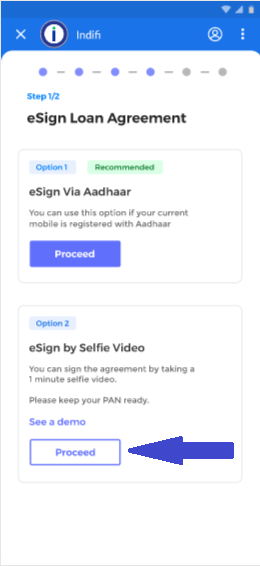

Step 1: Once the offer is accepted, you will get option to eSign or sign through a selfie video.

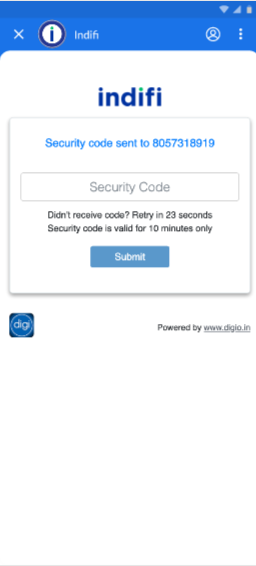

Step 2: Select the first option "eSign Via Aadhar" by clicking on the proceed button under first option. You will receive an OTP on your mobile phone registered with Indifi.

Step 3: Now you will be able to review the agreement. At the bottom of the screen you will see option to sign agreement. Click on "Sign Now".

Step 4: In the next screen, please provide your Aadhaar Number/VID. An OTP will be sent on the registered email/mobile number link to that Aadhaar.

Step 5: Enter the OTP received to complete the eSign process. After successful submission, you will get "Thank You" page and signing process is complete.

Step 1: Once the offer is accepted, you will get option to eSign or sign through a selfie video. Please select second option as indicated below.

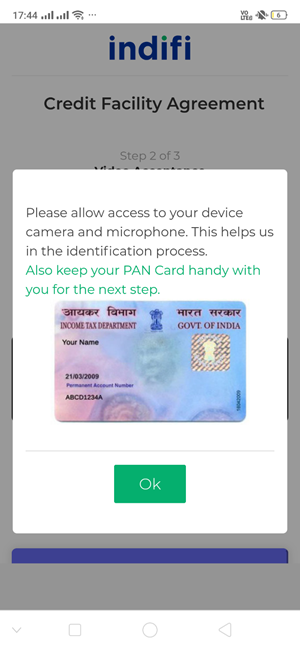

Step 2: Next screen will contain guidelines to complete video signing and access to camera/microphone/location. Also, you will require your PAN Card during the process. Please keep it handy and then click on OK.

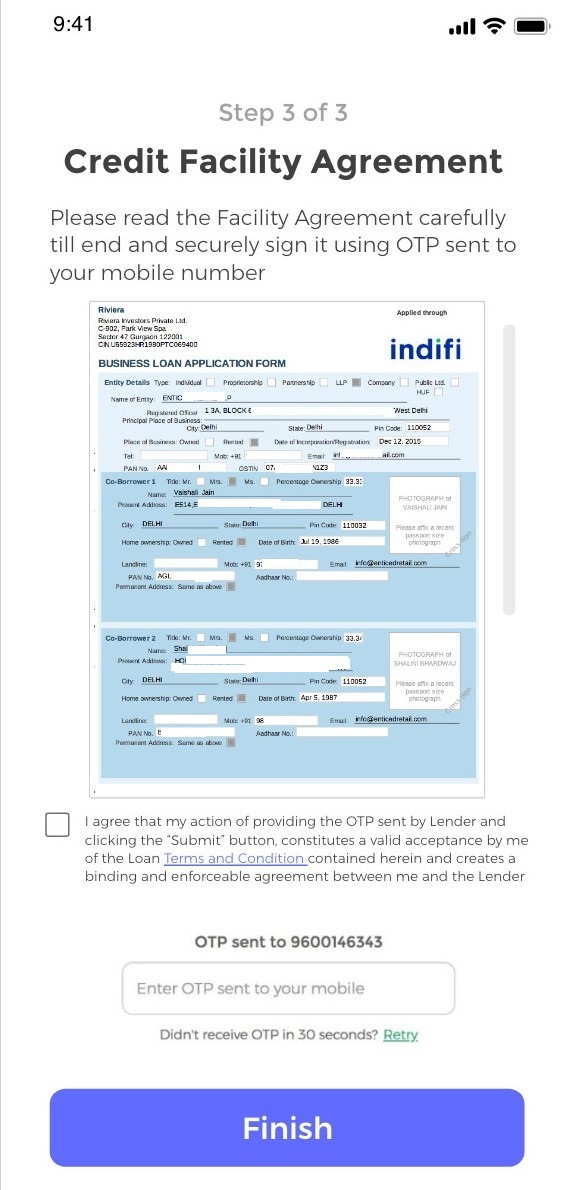

Step 3: Start your video by clicking on the "Start" button. You will see instructions at the bottom of the page. You need to clearly speak 4 digits mentioned on the screen and show your PAN card clearly.

Once you have completed both the mentioned steps, click on "Next" button.

Step 4: Next screen will contain the agreement. Also, you will receive an OTP on the shared mobile number. Please provide OTP at the bottom of screen to sign the agreement.

You can authorise an eMandate using your netbanking login or your debit card and PIN.

Step 1: click on the option 1 - "Set up eMandate"

Step 2: Next screen will show you details of the mandate. You can select Net Banking or Debit Card (depending on whether that bank has that option), then click Continue.

Step 3: You will be redirected to the NPCI website and then to your bank's website. This next step varies depending on your bank's process. Some banks will do the next two steps in reverse order.

Step 4: Review the mandate details and click on the button to proceed.

Step 5: Log into your internet banking or enter your debit card and PIN (depending on the option you selected earlier).

Step 6: You will need to enter an OTP that you receive via SMS to the mobile number registered with your bank. Some banks may also ask your permission to do a one Rupee transaction to authorise the mandate.

You will be redirected back to NPCI, back to LotusPay, and then back to your merchant's website.

That's it - all done!

Troubleshooting tips

In rare cases, you may have trouble completing the above steps. Not to worry! You can always try again using the same link that you started the process from.

SMS not received

If you did not receive the SMS within three minutes, there could be a few reasons:

- Issue: The SMS went to a different mobile number than what you were expecting. Solution: That must be the mobile number registered with your bank. Go ahead and use the OTP.

- Issue: There is a delay in the system. Solution: Wait some time and try again later.

Error message on NPCI website or bank website

If you're seeing an error message on the NPCI page:

- Issue: You entered an invalid bank account number. Solution: Double check the bank account number that you entered matches the netbanking login or debit card that you are using for mandate authorisation.

- Issue: There is a system error. Solution: Wait some time and try again later.

You can opt from the following three options for re-paying your loan

- E-Collect Payments

- NACH (An auto debit facility)

- Cheques

- PayTM (Recharge & Pay Bills -> Pay Loan -> Search ‘Indifi’ -> Enter Application ID)

- PhonePe (Loan Repayment -> Search ‘Indifi’ -> Enter Application ID)

There are fixed frequency (agreed at the time of loan booking) on which Indifi will initiate a repayment request against your account. However, you can pay any additional amount that you would against your loan by using the Virtual Account method or Phone Pe / Paytm app.

By paying additional amount, you will achieve following benefits –

- Save on interest

- Reduction in loan period

If you are using E-Collect as repayment mode, Indifi collects the EMI amount in tranches. If for some reason, complete EMI is not collected, the same is collected using your NACH/ Cheque. The final amount is sent to you post the last day of the previous month along with the entire month’s collection details.

No. NACH is presented to your registered bank account automatically against any amount not paid during e-collect. You can not push NACH to a late date or cancel it.

If funds received in your E-Collect account were not sufficient to clear your complete EMI and Overdue (if any), NACH will be presented

NACH amount is identified using outstanding on the last working day of previous month. In case you are making a payment between 1st to 5th of the month, NACH will be presented basis the last month’s outstanding

- CIBIL keeps a track of all payment delays

- In case of >30 days default, the CIBIL score is reduced impacting your future loans

As per the RBI notification, Indifi Capital had provided its customers an option of availing moratorium on EMIs of their loan.

Customers who chose a moratorium, interest in their loan account continued to accrue on the EMIs for which moratorium is provided at the same rate as contracted for the loan and such interest is to be collected by extending the original tenor of their loan. There is no change in terms and conditions of the loan with Indifi Capital Pvt. Ltd

On acceptance of moratorium, no cheque bounce charges or overdue charges are levied to loan account for such EMIs covered under Moratorium

For loans which are covered under deduction at source and E-Collect mechanism, the lender reserved the right to continue with such deductions during the moratorium period.

Amount collected before 5th Aug will be considered as part payment and amount collected post 5th Aug will be adjusted against Sep'20 EMI.

RBI has provided a framework to lending institutions for implementation of resolution plans for addressing the economic fallout due to the COVID-19 pandemic which has led to significant financial stress for customers. Basis the framework and regulatory guidelines, Indifi Capital has framed its policy for the restructuring of the loan/s of entities that have been impacted due to the COVID-19 pandemic. It may be noted that Indifi Capital retains the discretion to take decisions for approving restructuring, in line with its policy and RBI guidelines basis case and product specific aspects.

- Individuals and Entities that are Non NPA as on March 1, 2020 are eligible for restructuring.

- Businesses which are running and not shut on date of restructure

The balance tenure of the loan can be extended by a further period to a maximum of 36 months to ease your monthly EMI repayment burden.

- Write an email cs@inidifi.com from your registered email id

- You will be assigned a relationship manager who will guide you with the process

- It may be noted that Indifi Capital retains the discretion to take decisions for approving restructuring, in line with its policy and RBI guidelines basis case and product specific aspects.

The unpaid EMIs along with the accrued interest have been added to balance outstanding. Hence the additional amount is the accrued interest on the unpaid EMI which you have to pay at the end of the loan tenor

As per Company's Moratorium policy, all eligible customers with unpaid instalments during the moratorium period have been automatically granted moratorium for the eligible period

It will adversely impact on your CIBIL as basis the RBI guidelines lenders are required to submit loan performance to bureau agencies on monthly basis. We would request you to clear your EMI and dues on time to remain current or it will directly impact your ability to take future loans.